The current market sell-off has many market participants running for cover and waiting till the “uncertainty clears.” Issues concerning the market are well-known – central bank tightening, high inflation, the Ukraine conflict, supply chain shortages and increasing concerns of a recession in 2023.

And in current markets, I am reminded of the timeless words of Benjamin Graham (the father of security analysis and Warren Buffet’s mentor) who made the clear distinction between investment and speculation.

In his seminal work “The Intelligent Investor” on the very first page he makes the following observation:

“An investment operation is one which, upon thorough analysis promises safety of principal and an adequate return. Operations not meeting this definition are speculative.”

Defining an adequate return

When reading this quote the key word is adequate. Note that Graham makes no mention of market timing or predicting a bottom – a practice much loved by sell-side strategists. So what is considered an adequate return?

Over the 100 years to December the S&P 500 has given an annual return of 8% p.a. Equity returns are simply a function of:

- earnings growth

- dividend yield, and

- price to earnings (PE) expansion / compression.

The S&P 500 path to adequate

Let’s break down these constituents:

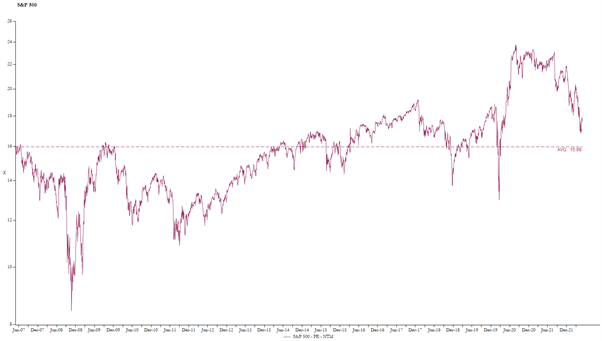

Earnings growth: looking at 2007 as our starting base (i.e. peak of that cycle) and using consensus earnings in FY22 – earnings per share (EPS) growth was on average close to 6 per cent per annum over the 15-year period. We think this number is a reasonable proxy of our long-term estimate for future earnings growth.

Dividends: the current dividend yield is 1.6 per cent.

PE expansion/compression: this is the hardest to forecast and requires an accurate forecast of future investor psychology and interest rates. Over the last 15 years the market multiple has averaged 16 times and the current multiple is 17.4x. Assuming a reversion to 16x over 10 years would detract 0.8% p.a. from an investor’s return.

Source: FactSet

If we add these three constituents together it leads to a return of 6.8% per cent - somewhat short of the long-term equity return of 8 per cent. And while this may not be quite “adequate”, it is still a reasonable return compared to what’s currently on offer in a savings account – although hopefully news here is improving and central bankers will offer some comfort to hard-pressed pensioners!

This assumes one invests in the market through an index fund, where for the purposes of this article I have ignored passive fees. And as an active manager trying to beat the market – we have always targeted a long-term return of 8-12 per cent per annum. This is why last year we were cautioning clients that we expected future returns to be at the bottom end of our targeted range, given the elevated valuation of the market.

However, the recent market sell-off has us feeling far more constructive and on the front foot with clients. Let’s now look at this by breaking down into the same three constituents.

The Claremont path to adequate

Earnings growth: we believe our companies could deliver earnings growth over the long term in the low double digits.

Dividends: the current yield on the fund roughly equates to our active manager fees.

PE expansion/compression: our fund holdings now trade 1 per cent below their 10-year average and 13 per cent below the five-year average. We would argue that it is not unreasonable to expect PE multiples to have a neutral impact on future returns over the long-term.

So, if we put this all together – we are much more confident of hitting the right side of that 8-12 per cent per annum equation than we were a few months ago. We know we have little ability to call the bottom, however at current prices we believe we have a reasonable probability of achieving an adequate return.

The art of patience

To conclude with Ben Graham and one of my favourite quotes on market fluctuations in Chapter 8 of the Intelligent Investor:

“The speculator’s primary interest is in anticipating and profiting from market fluctuations. The investor’s primary interest lies in acquiring and holding suitable securities at suitable prices.”

The sell-off this year has already seen us add two companies to the portfolio – companies we have been following for years while we waited patiently for an entry point. And now with 13 names in the portfolio and a cap of 15 – we have room for two more. Whilst no one likes a falling share market, it opens up a wider opportunity set for us and the ability to acquire truly great businesses at prices that ensure a fair risk-adjusted return. We intend to do just that.

Disclaimer

The information in this article may contain general advice. Any general advice provided has been prepared without taking into account your objectives, financial situation or needs. Before acting on the advice, you should consider the appropriateness of the advice with regard to your objectives, financial situation and needs.

This information has been prepared by Claremont Funds Management Pty Ltd (Investment Manager) (ACN 649 280 142, ABN 38 649 280 142, CAR No. 001289207), as investment manager for the Claremont Global Fund (ARSN 166 708 792) and Claremont Global Fund (Hedged) (ARSN 166 708 407), which are together referred to as the ‘Funds’. Equity Trustees Limited (ACN 004 031 298, AFSL 240957) (“Equity Trustees”) is the Responsible Entity of the Funds. For further information on the Funds please refer to each Fund’s PDS which is available at www.claremontglobal.com.au. The Target Market Determination for the product can be available by contacting your adviser. A Target Market Determination is a document which is required to be made available from 5 October 2021. It describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. It also describes the events or circumstances where the Target Market Determination for this financial product may need to be reviewed.

Past performance is not a reliable indicator of future performance.

This article may contain statements, opinions, projections, forecasts and other material (forward-looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. The Investment Manager and its advisers (including all of their respective directors, consultants and/or employees, related bodies corporate and the directors, shareholders, managers, employees or agents of them) (Parties) do not make any representation as to the accuracy or likelihood of fulfilment of the forward-looking statements or any of the assumptions upon which they are based. Readers are cautioned not to place undue reliance on forward-looking statements and the Parties assume no obligation to update that information. The Parties give no warranty, representation or guarantee as to the accuracy, completeness or reliability of the information contained in this report. The Parties do not accept, except to the extent permitted by law, responsibility for any loss, claim, damages, costs or expenses arising out of, or in connection with, the information contained in this article. The information provided in the article is current at the time of publication. The views expressed herein should be considered as part of a wider portfolio investment strategy applicable to the Funds and should not be considered in isolation or relied on to make an investment decision without seeking further information and/or advice from a financial adviser.