At Claremont Global, a 10 to 15 stock concentrated quality growth manager that invests globally, we look at the portfolio in terms of the 4Ps: People, Process, Portfolio construction, and Performance. This approach has delivered over 8% per annum in alpha over the last three years.

If I look at the people in the team, we've got collectively, over 70 years’ experience in global investing.

I have over 27 years in global investing. I pretty much always looked at stocks as looking at a portfolio of 15 stocks, for quality, focused growth investing.

Behind me, I have an analyst team from all around the world, from South Africa, Mexico, Australia, and elsewhere.

As for process, the fund was started in 2011, when we had just come through the GFC and we were just about to go into the European sovereign debt crisis. From day one, we were always focused on downside protection and capital preservation. For us, the fund is about what we call predictable outcomes and having a repeatable process.

We're not forecasting interest rates. We're not for forecasting oil prices. We're not forecasting thematics.

Then there's portfolio construction. We build one stock at a time, looking at quality businesses where we have a very high conviction in what that business will be earning in five years and what its competitive advantage is. And as I said, we build it one stock at a time. We don't put big macro predictions on the portfolio.

This brings us to performance.

Our targeted return is 8% to 12% per annum over the long term, which we define as 5 to 7 years. Why 8% at the bottom end? Well, let's say inflation over the longer term is around 2%. We want to be earning at least a 6% real return on that. And if we can get a bit of excess return over that, we'll be happy.

There are two things we always try to remember when we're investing. They both come from Warren Buffett. 1. You only have to get rich once. 2. Never risk money you need for money you don't.

We think if you can compound your money over long periods of time at 8% to 12%, the outcome will be just fine.

And as a fund, we have $1.2 billion under management, which is a nice size to fund a fully-fledged research effort, a fully-fledged client service effort, but not being too big that we can't invest in mid-cap names that are in the 10 to 12, 20 billion range and that we think are clear global leaders.

If you’d like to know more about why we think concentrated investing suits us, suits our clients, and suits the way we look at the world, watch the video below.

Edited transcript

Bob Desmond: Hi, I'm Bob Desmond, Head of Claremont Global & Portfolio Manager. Claremont Global is a 10 to 15 stock concentrated quality growth manager that invests globally.

Today, I'm going to speak to you about why we think concentrated investing suits us, suits our clients, and suits the way we look at the world.

As above we look at the portfolio in terms of the 4Ps: People, Process, Portfolio construction, and Performance. We also have four key tenants when we look at a business.

For us, a quality business is one that earns higher returns on capital through an investment cycle. And the other thing we look for in our businesses is decent organic growth.

It doesn't have to be go-go growth. We just want consistent organic top-line growth that is better than nominal GDP growth.

When we look at our returns on capital, we look at it through a cycle. So you'll never see our certain businesses that earn high returns on capital at the top of a cycle, something like an investment bank only at the bottom of the cycle to be going to shareholders or governments or cutting dividends because their balance sheet is in trouble.

We always buy businesses with strong balance sheets across the portfolio. We're almost net cash. We look for decent management, again, not particularly original. Haven't seen anyone who wants bad management, but for us, what we want is two key things in management.

One is a relentless focus on the core and then decent capital allocation. And one of the things I like to say to people is management often confuse their brilliance with a company's competitive advantage. And what ends up happening is they then take the beautiful cash flows that are coming off the core and divert them to other businesses.

And for us, growth is not a strategy. What we want businesses to do is to relentlessly build that competitive advantage and build them out. And then with that cash flow, give it back to shareholders either in the form of dividends or buybacks, and where possible, make sensible bolt-on strategic acquisitions.

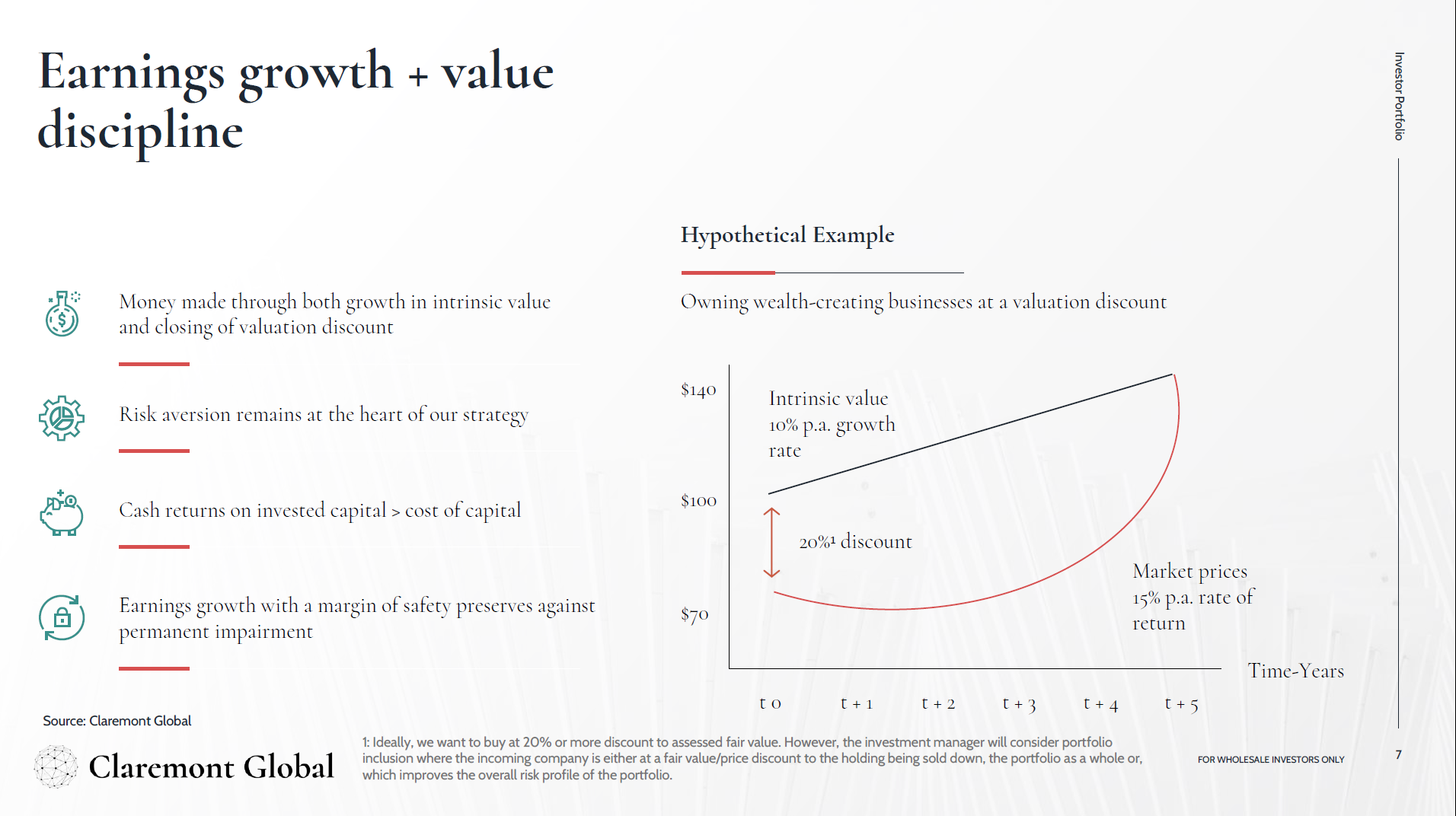

And then finally, to get that 8% to 12%, we obviously have to buy that business at a fair price that will allow our clients to get a decent risk-adjusted return.

Turning to some of the other attributes we look at in our businesses, dominant market positions, that's pretty much a given. If we actually look at the portfolio, the average age of the stocks we hold and that's the heritage is over 80 years old and the oldest is over 160 years old.

So these are stable businesses and generally in oligopolies with very stable industry structures.

A key attribute we like to look at is what we call a low cost to value. And probably the best example I can give of that is something like Microsoft where if you think of the cost of a Microsoft Office 365 licence, it's $29 a month.

Most people spend more on that than coffee or beer a month. So you cannot get into a discussion with Microsoft and ask them to reduce prices. It is just so integral. You can't switch out of that product. It is absolutely integral to you running your personal life or running your business. Those are perfect businesses for us.

We try and find companies that have a good culture. If a company only talks about creating shareholder wealth, that is normally a red flag for me.

I'm looking for companies that are obsessed by customers, who treat their employees well, and have decent incentive structures and treat their shareholders fairly.

Earnings power's crucial. So that 8% to 12% return we're looking for, we want that to come from earnings growth.

What we're not looking to do is to buy cheap stocks and then flip them, and then buy another cheap stock and flip that to get our return. We're looking for long holding periods.

And if that business consistently grows its earnings and its dividends, its value will follow.

And then finally, we're looking for breadth in our businesses. Businesses who do lots of things in lots of geographies and have lots of products. Obviously with a 10 to 15 stock portfolio, we need to get the diversification through the businesses rather than through owning lots of different businesses.

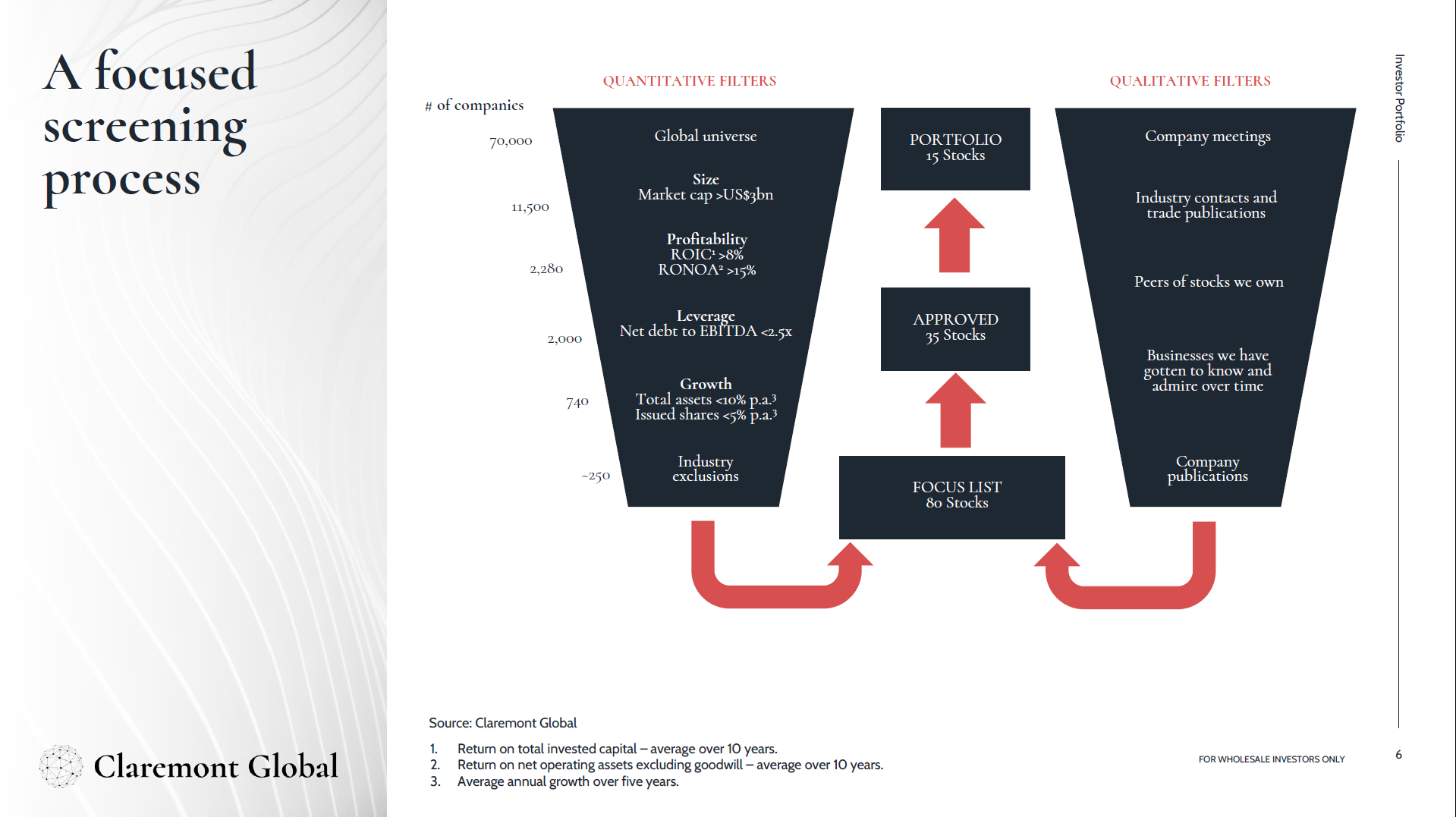

How do you get from a global universe of 70,000 stocks to a watch list of 100, an approved list of 40 and a portfolio of 15 stocks?

We screen at market cap. So generally, our market caps will be above 3 billion. More often, they're likely going to be 10, 12, 20 billion and above. We screen on return on capital. So we want to get a return on capital that averages 8% over a 10-year period and a return on tangible capital that averages over 15% over a 10-year period.

We screen out bad balance sheets, i.e., debt to EBITDA over two and a half times. We will tolerate a slightly higher level of debt if a company's made a good sensible strategic acquisition, and they commit to paying the debt down quickly.

Then we screen out businesses that have what we call excess growth. That have grown either through issuing shares, making expensive acquisitions, ballooning the balance sheet with debt and intangibles. We screen them out.

And then we screen out all sorts of industries that what we call regulated, complicated, leveraged or commoditised. So that would include banks, resources, utilities, pharmaceuticals, biotech. And from that, we put together a focus list of 80 to 100 stocks and approved list of 40 stocks. And from that, we pick a portfolio of 15 stocks.

One of the big topics at the moment is value or growth. And it's probably been a perennial question. I think Warren Buffet describes it quite well when he says growth is actually a component of value. They're joined at the hip.

Value or growth? Both

For us, we are basically both. If we can find a business that's growing its earnings roughly at 10% per annum, and we can buy that at a 20% discount of value, and that discount closes over five years, we're probably looking at doubling our money over five years without taking a huge amount of risk. That's the perfect investment for us.

By the same token, you'll find businesses in the portfolio which we'd say are right up at the high growth end, something like an Alphabet or a Visa going to grow their top lines 15% to 20%.

But at the other end of the portfolio, we could own businesses like Diageo or CME where their top lines are growing not much faster than nominal GDP growth.

The key thing with all of those businesses is they have entrenched competitive advantage that is growing and we expect to grow over the next five years.

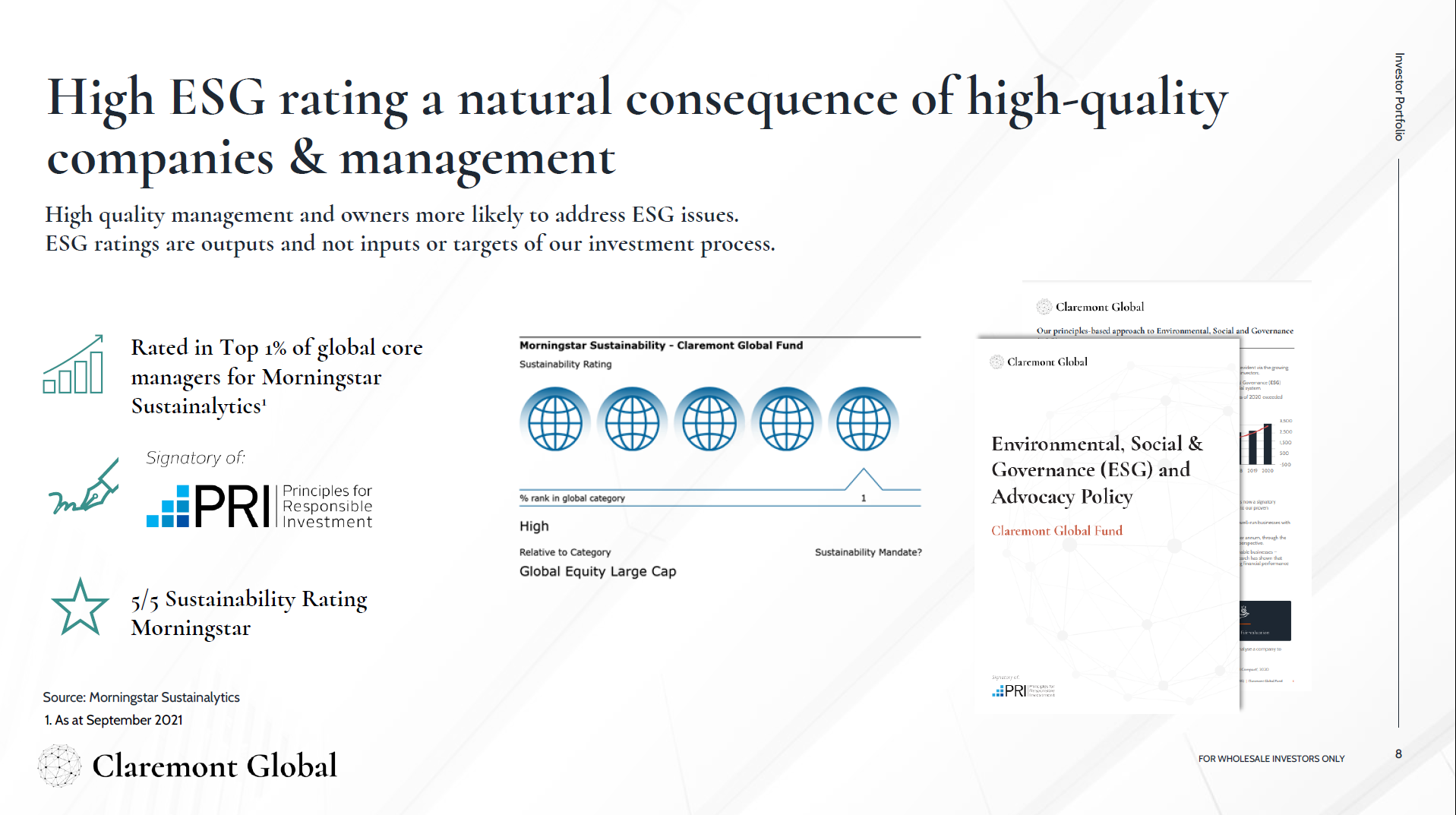

ESG is a big topic at the moment and rightfully so. From our viewpoint, ESG though is an outcome of our process. It's not how we build the portfolios. First and foremost for us is getting decent financial returns for our clients, but for us, good governance, good environmental, and good social things are a key part of building a sustainable business.

So obviously, if you're a business that doesn't treat your customers well, that doesn't look after your communities, that pays your workers badly, that doesn't have fair incentive structure and doesn't treat your shareholders fairly, you're not going to be able to build a business.

Like we said, we have businesses that are over 80 years old. They must have done a lot of these things over time to build that sustainability. As it turns out, when we actually look at the portfolio, if you look at our sustainable ratings as done by Morningstar, we're in the top 1% of managers rated by them globally in terms of our ESG ratings.

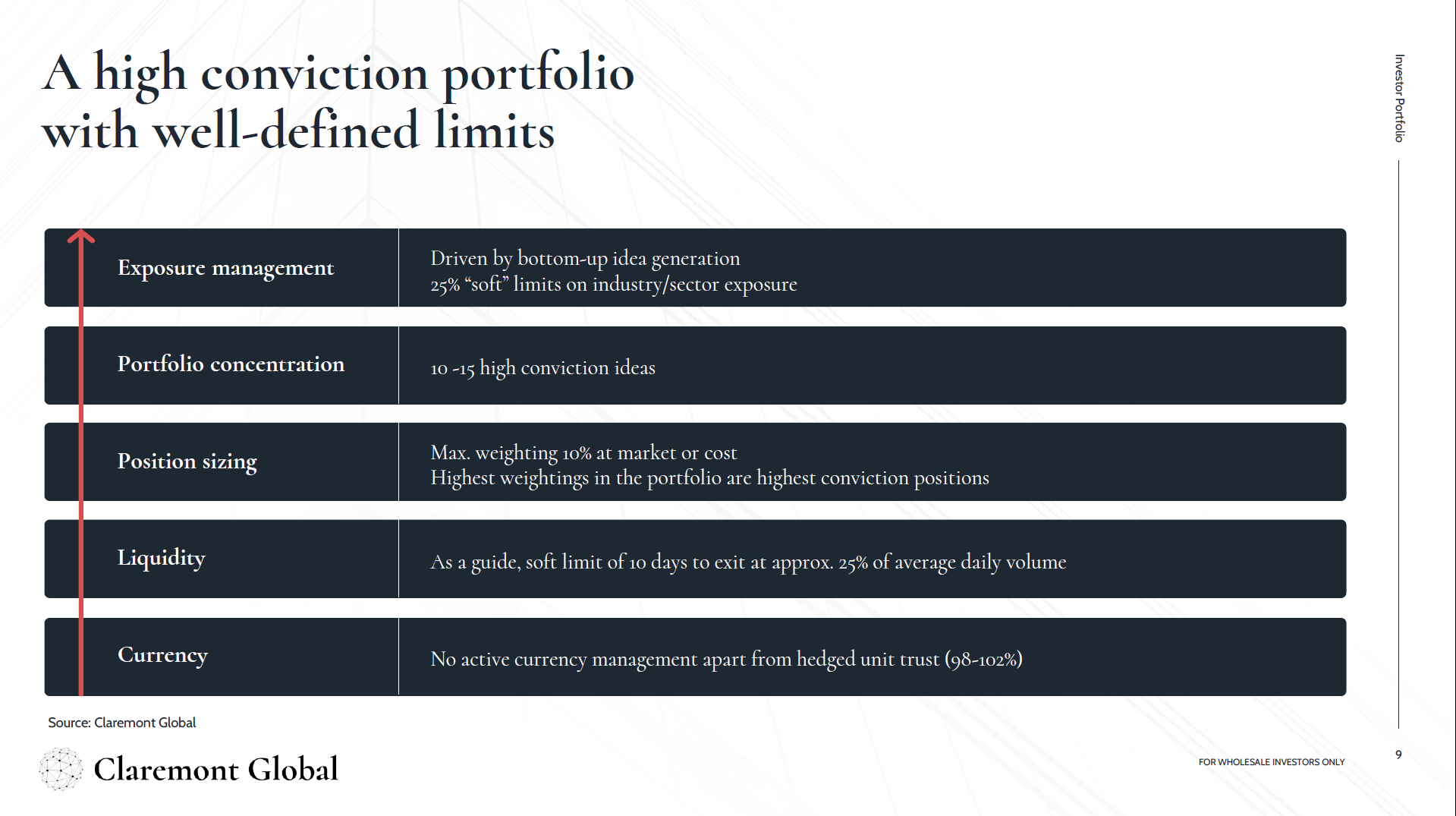

We build the portfolio. It's a pretty well-defined process. It's a 10% max position by stock, 10% maximum cash holdings. Clients have given us their capital. And we try and invest that. We don't have higher cash holdings or try and raise cash limits because we are concerned about the markets.

At the end of the day, we're building the portfolio one stock at a time. It's a very concentrated portfolio. It's 10 to 15 high conviction ideas. And we invest in very liquid stocks. As it stands today, we could liquidate the whole portfolio in one trading day.

We basically have a rule that we want to be out of our stocks in two weeks, in 10 trading days, being no more than 25% of the total value traded. And then in terms of currency, we don't pick currencies. We leave that to our clients. We basically have 100% hedge portfolio and 100% unhedged portfolio, and we leave the client to decide.

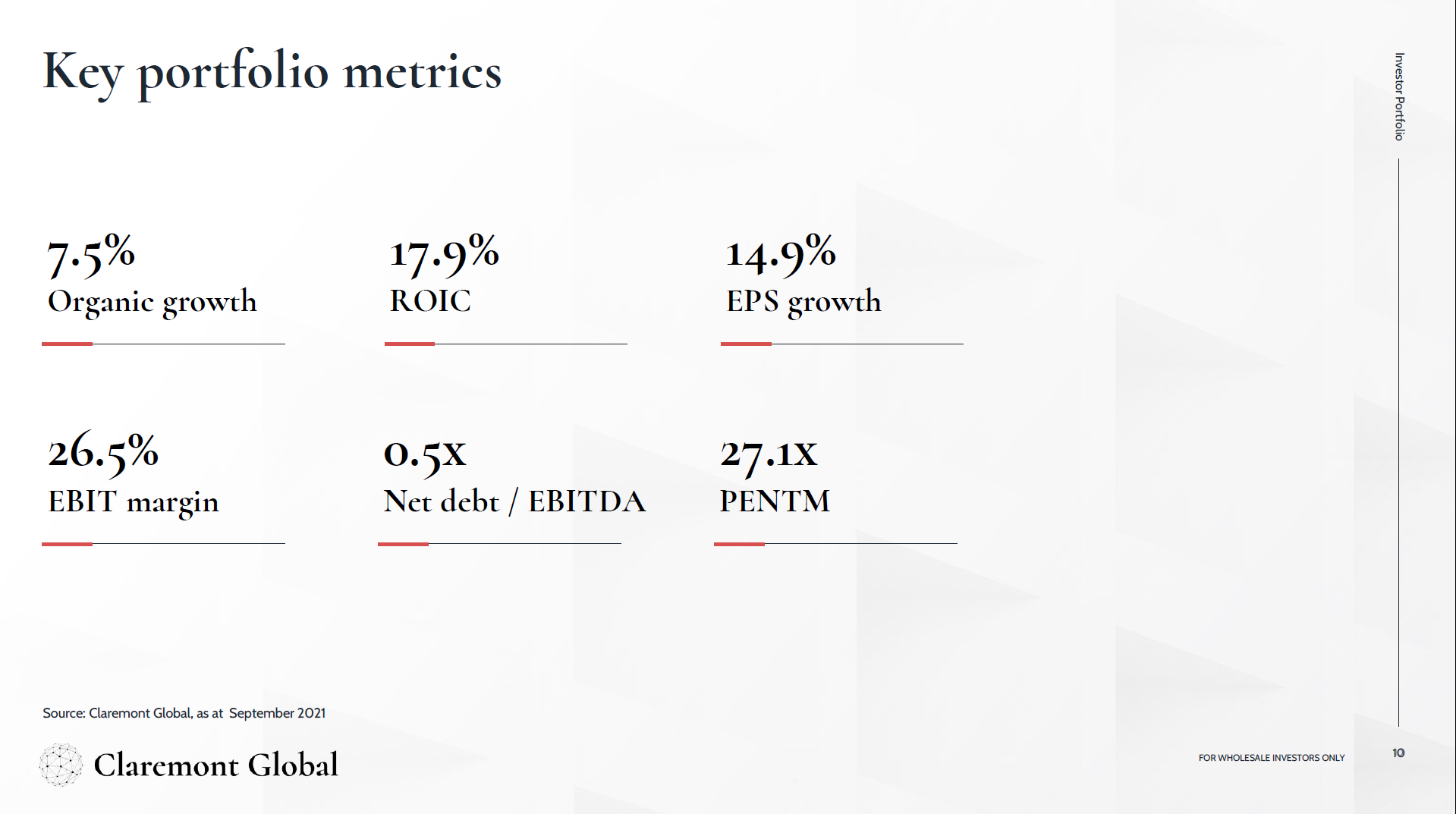

As it stands today, as I look across the portfolio, our businesses are delivering around 7% organic growth. That's pretty much twice what the market's delivering. We have a return on invested capital across the portfolio of 18%, which is again about twice what the market's delivering.

Our EPS growth across our businesses is around 15%, probably two times what the market's delivering. Our profitability margins across the portfolio are 26%. That's actually more than twice what the market's delivering. And as I said at the beginning, our balance sheets are almost net cash. For that currently as it stands today, we are paying around 27 times across the portfolio.

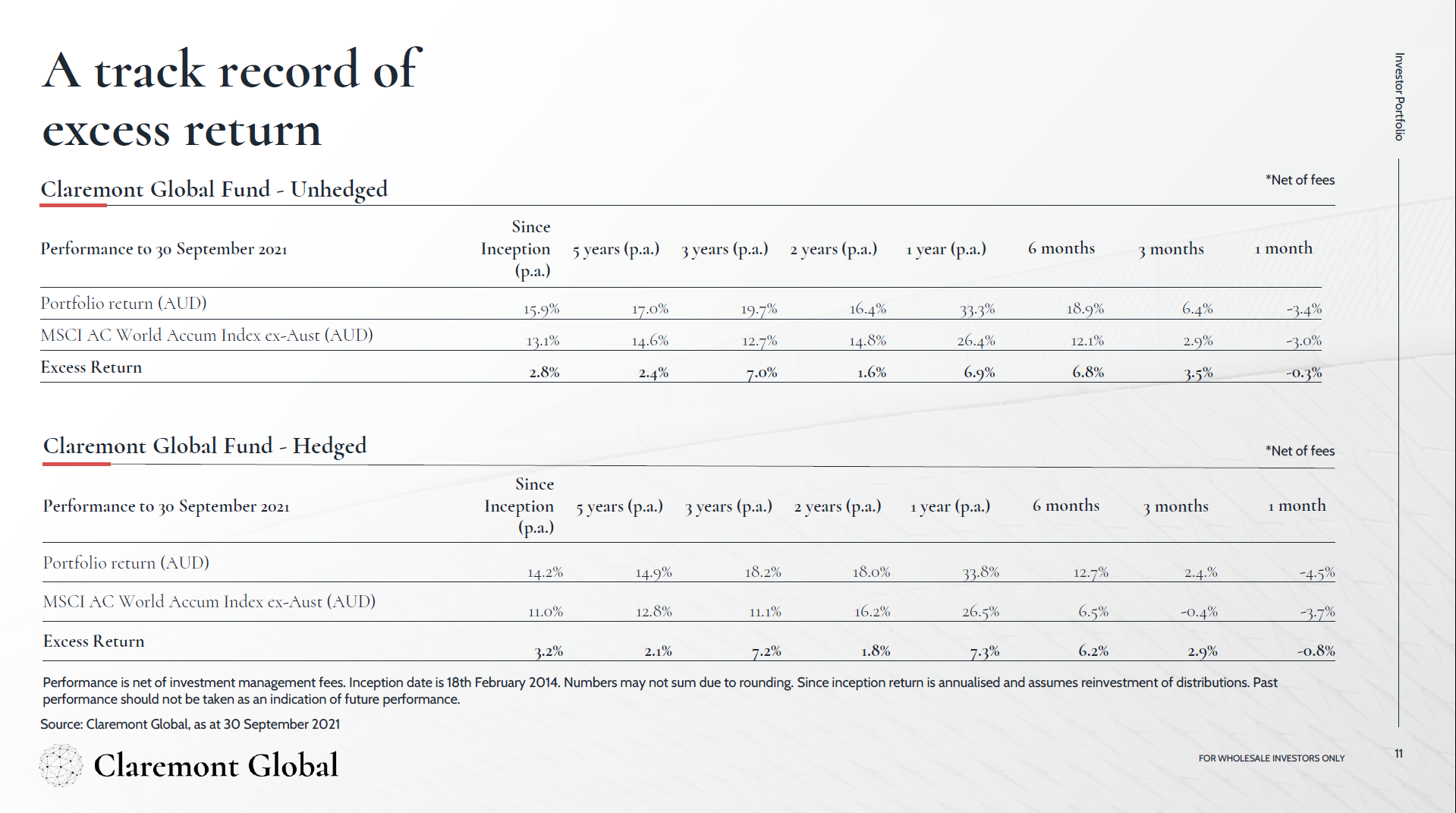

This is our track record. You'll note that the returns that we present here are back to front. We think looking at anything less than three years for returns to clients is probably not really meaningful. We like to look at returns over a five to seven year cycle.

You can see since inception, the unhedged unit trust has delivered around 3% alpha, over 3 years, 7%, and over 5 years, 2%. Our targeted return for alpha is 2% to 4% through an investment cycle.

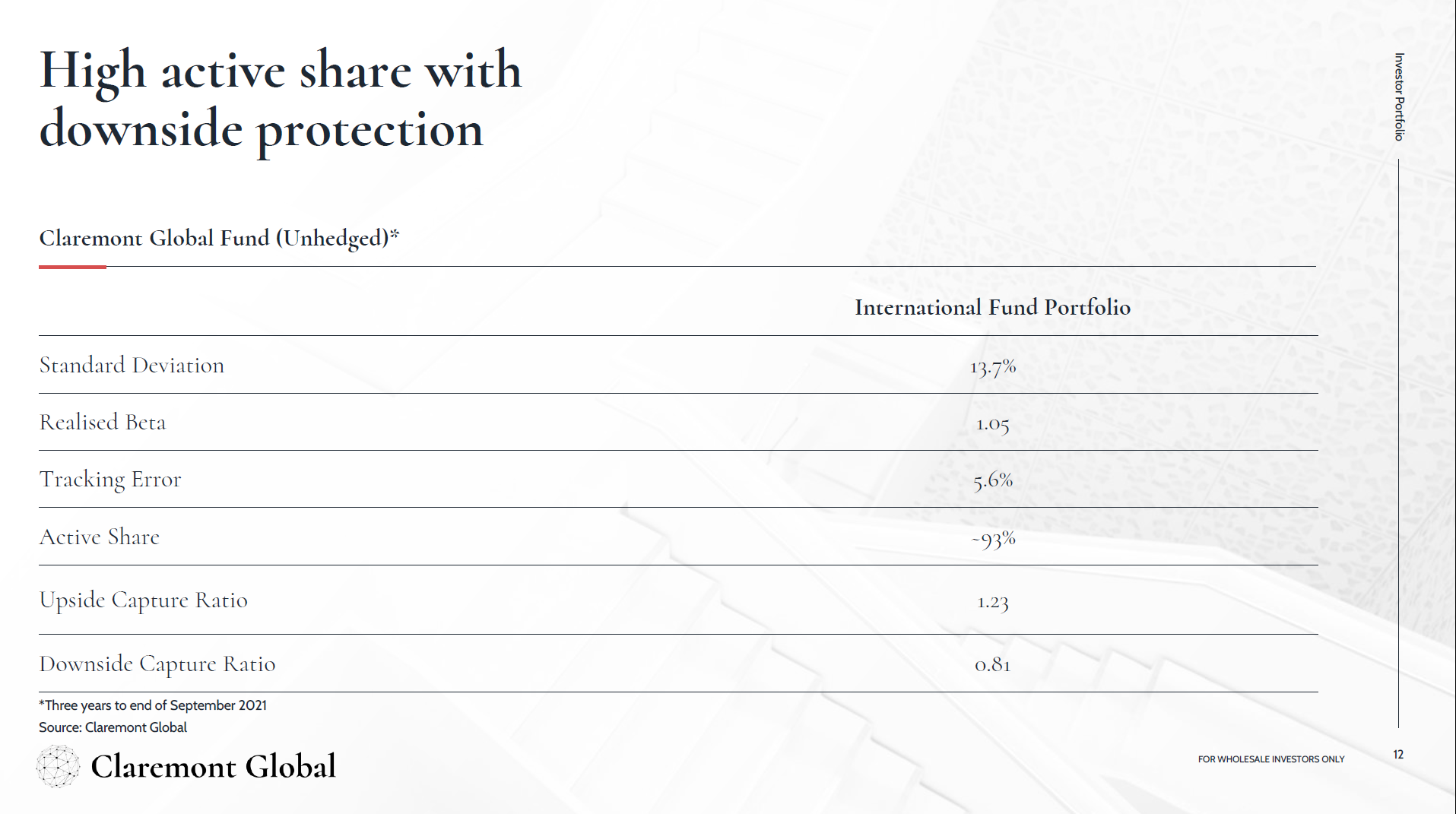

In terms of the characteristics of the portfolio, a couple I like to point to to clients is the standard deviation is pretty much similar to the market and that's despite having a 10 to 15 stock portfolio. And I think that speaks to the quality of the businesses that we own.

It is a very active portfolio. Clients pay us active fees and we are truly active. Our active shares are over 93% and our downside capture is about 0.8, which is much less than the market. And I think, again, that speaks to the quality of the businesses that we own.

So to sum up, why do I think this fund is different? There's a lot of very good fund managers in the world. We compete in the crowded market. And so I try to highlight to clients where I think we could be slightly different to your average manager.

First of all, the portfolios, 10 to 15 stocks. That's pretty rare. Most fund managers like to run, within my opinion, portfolios that are too diversified and you're actually spreading your capital across. We want to concentrate our capital in our best ideas.

We have a decent track record over long periods of time with good downside protection. We have nice scale. We have 1.2 billion under management, which is about the right size for us to give a fully-fledged research and client service effort, but not too big that we can't invest in global leaders that are mid-cap names.

We have a boutique culture, we're a tight team of seven professionals, and all our incentives are aligned to the strategy, and our client service team only speak to the strategy. And that allows them to become experts in their matter and talk on our behalf to our clients in a very knowledgeable way.

We have a strong parent which allows us and the portfolio managers to do the things we like doing, which is basically researching companies and talking to our clients. We don't have to spend time doing admin, compliance, IT, shared services, financial services licences. We are not distracted by that and we're focused on what we do best, which is looking at the portfolio and talking to clients.

We are only at $1.2 billion. We think we have a lot of capacity for growth. With the strategy today and the liquidity constraints we've got, we think the strategy could easily be $7 to $10 billion.

And finally, the last thing I always like to point to clients is we have strong tenured relationships with many of our clients. The strategy is over a decade old, and a lot of our clients have been with us for that period of time.

The beauty of that is that they give us time to let the strategy work. They know the strategy, they know the stocks, they know us. And so when markets get difficult, which they do, they stick with the investments through time and they know that we will talk to them in a way that they understand and that is fully transparent and that builds a trusted relationship with them and allows them to stay the course and to get the return they need from the portfolio.

I'll thank you for your time. And if you're interested in finding more about the fund, I'd direct you to our website. And also there, I'd say have a look at our investors manual which gives a very good outline of how we think about businesses and investing and how we think about clients. Thank you.