When thinking about COVID winners, a 70-year-old US-centric payroll solutions company is unlikely to be top of mind. However, complex requirements for stimulus applications through the pandemic ― combined with the ability to develop solutions to service these changes ― has entrenched NASDAQ-listed ADP with its client base more than ever.

We see ADP as an attractive quality compounder with a 45-year track record of consecutive dividend increases and in this article cover some of the many reasons why ADP has made it into our 15-stock portfolio.

Automatic Data Processing (NASDAQ: ADP)

ADP is a leading global provider of payroll and Human Capital Management (HCM) solutions, which includes payroll and tax management, compliance, benefits administration, and workforce management. The company began its operations in 1949 and now delivers the payroll for one in six workers in the US (~26 million) and a total of 15 million workers internationally. ADP has a client base of around 900,000, ranging from small businesses to large enterprises. The company generated US$14.6 billion in revenue in FY20 (June year-end) and has a market capitalisation of US$80 billion.

Mission-critical solutions at a small cost to the client

As part of our investment criteria, we look for companies that offer high value-add to clients. In particular, we like companies whose products or services are mission-critical to client operations, but which only comprise a small fraction of client costs.

In the case of ADP, its core value proposition comes from payroll processing, a critical task in any organisation. And a key element of effective payroll processing is tax compliance, which is not an easy task.

In the US alone, ADP works with more than 7,000 government tax agencies. And for more than 70 years, the company has maintained a strong track record, maintaining compliance for customers in ever-changing employment and tax legislation environments.

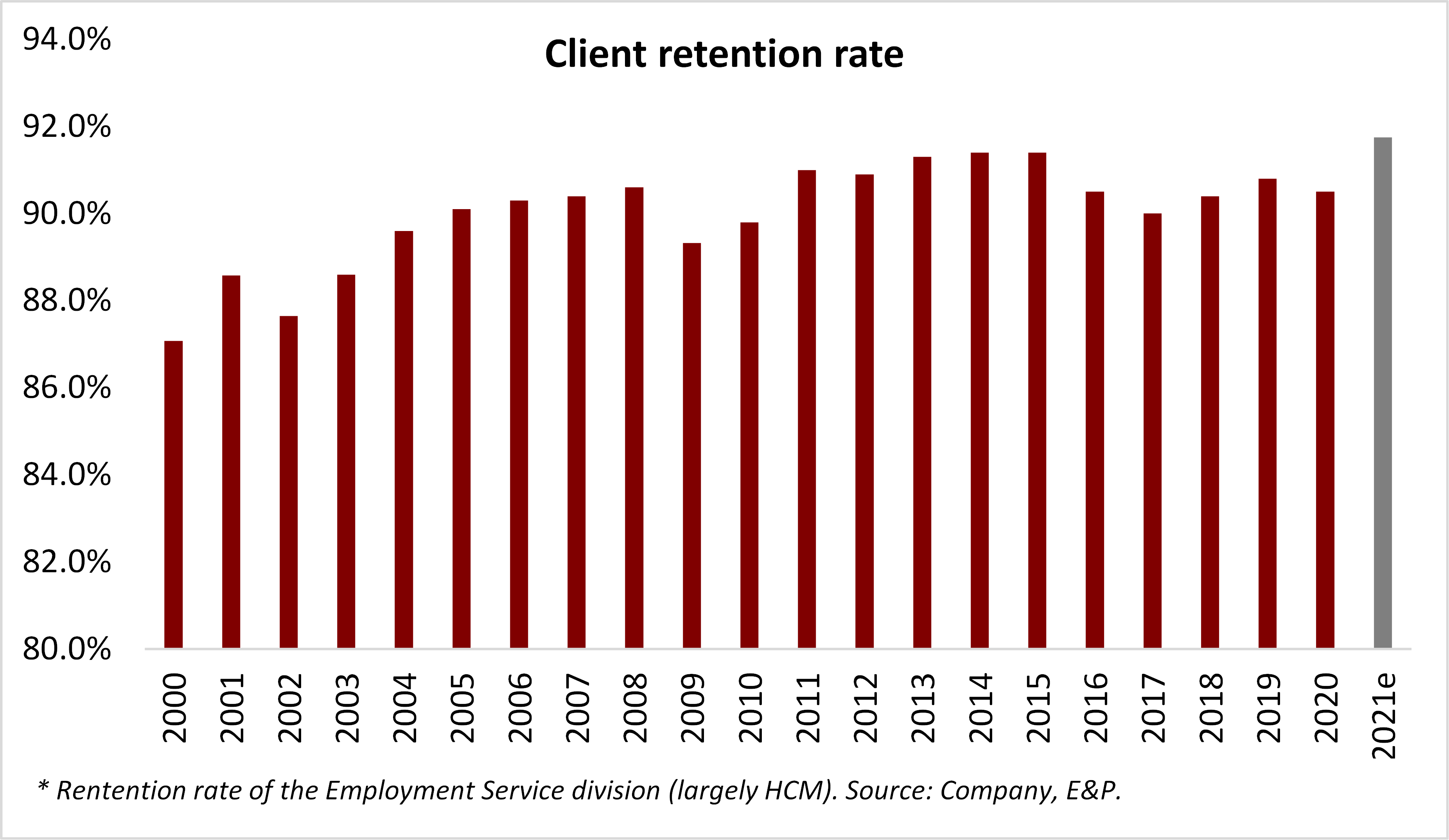

At the same time, even the cost of ADP’s most comprehensive solution would only represent a low single-digit percentage of total wages paid. The high value this provides has enabled ADP to more than 90% of its clients over the last 10 years, underpinning the company’s attractive operating margin of more than 20%.

Customer-first culture drives record retention through the pandemic

We are attracted to companies that have client satisfaction as their number one objective.

ADP’s strong customer focus is integral in maintaining the company’s strong client retention rates. This saw ADP maintain high levels of customer service during the height of the pandemic, despite the company facing slowing sales growth during this time.

As COVID unfolded, ADP quickly developed solutions to meet the complexities of applying for government assistance programs, maximising the outcomes for clients. By being close to its clients, we are confident the company will achieve a record client retention rate of around 92% in FY21.

Resilient revenue through the cycle, employment levels are not the biggest driver

Our investment process looks for companies that can show resilient earnings through economic cycles.

The high level of resilience demonstrated from ADP through the global financial crisis (GFC) and pandemic may surprise some. During the GFC, ADP’s revenue and earnings per share (EPS) were flat and during the pandemic (FY21) we anticipate low-single-digit revenue and EPS growth.

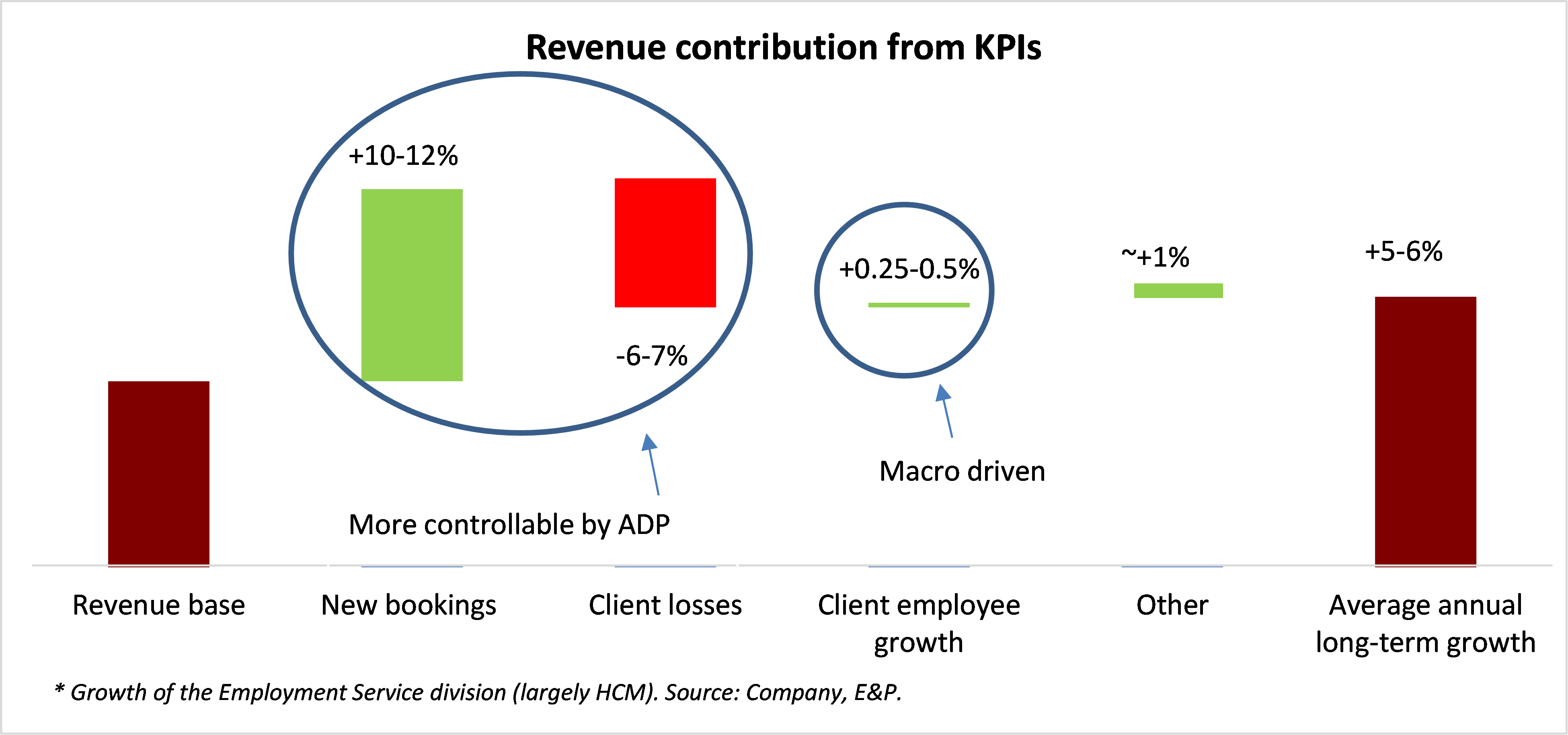

Most of ADP’s revenue growth comes from signing on new businesses and increasing the scope of products sold into that customer. While intuitively ADP’s sales should be closely linked to the overall level of employment in the economy, the exposure to employment levels is reduced, due to the fixed fee component in typical contracts. In fact, a 1 per cent change in employment levels only results in a ~0.25 per cent impact on revenue.

Importantly, ADP’s client base is well diversified and representative of the overall US economy. For ADP, the ability to sign on new customers and minimise client churn are the most important drivers of revenue growth as demonstrated in the chart below. The company’s salesforce (more than 6,500 specialists and 20,000 referring partners) drive new bookings growth.

Management accelerates the shift from payroll to leading HCM provider

Not surprisingly, management quality is a key investment criterion for us.

We want leaders that take decisive actions to build on the company’s competitive advantages and are also good capital allocators. In that regard, ADP CEO Carlos Rodriguez has shown these attributes and we believe that under his leadership the company has evolved from a legacy payroll processing company into a technology-driven leader in HCM.

Mr Rodriguez has had extensive experience with ADP, having first joined the company in 1999. He was eventually appointed to the role of CEO in 2011.

Key to ADP’s competitive advantage today was the early decision made by Mr Rodriguez to accelerate investments into R&D and technology, at a time when software as a service (SaaS) competitors such as Paycom, Ceridian and Workday were gaining scale.

He also oversaw the decision to divest the Dealer Services unit in 2014 (which comprised around 15% of group revenue at the time) to focus on the core HCM business. More recently, this has seen the company develop its first cloud-native platform (“NextGen”), which will drive a step-change in ADP’s product offering.

ADP is winning its fair share in a structurally growing industry

Globally, HCM is estimated to be a $150 billion market growing at 5-6 per cent ― but it remains a highly fragmented market and ADP is the largest player, with only ~10 per cent share.

For us, this means there is a significant portion of the market that is still untapped, with over 50 per cent of smaller businesses (i.e. less than 50 employees), still completing their payroll and HR functions in-house. This provides opportunity for all players to pick up market share.

While no doubt competition from SaaS/cloud players has risen over the last decade, ADP’s wide product offering, and direct service element has seen the company effectively compete against peers. Clients are unique and requirements often change as businesses grow or shrink. Competitors focus on a particular market segment (e.g. small business or enterprise) and have developed a business model suited to that segment.

We believe ADP has more flexibility to offer more tailored products, given ADP is the only player that services virtually all market segments with multiple platforms.

Looking forward

We believe ADP will come out of the pandemic stronger and its “NextGen” platform should see the company well placed to gain share in a structurally growing industry. HCM benefits from changes in regulation (e.g. healthcare or tax policy) and added complexity in working conditions (e.g. working from home, gig work). The pandemic has brought plenty of change and therefore we believe businesses will increasingly look to outsource HR functions which can provide long-term growth opportunities for ADP.