Market forecasting is perilous at the best of times. We don’t know anyone in 2007 that predicted there would be $17tn of negative yielding bonds in 2019; or the large amount of monetary stimulus that would be applied with limited inflationary consequences; or who predicted Brexit or that Trump would become President of the USA.

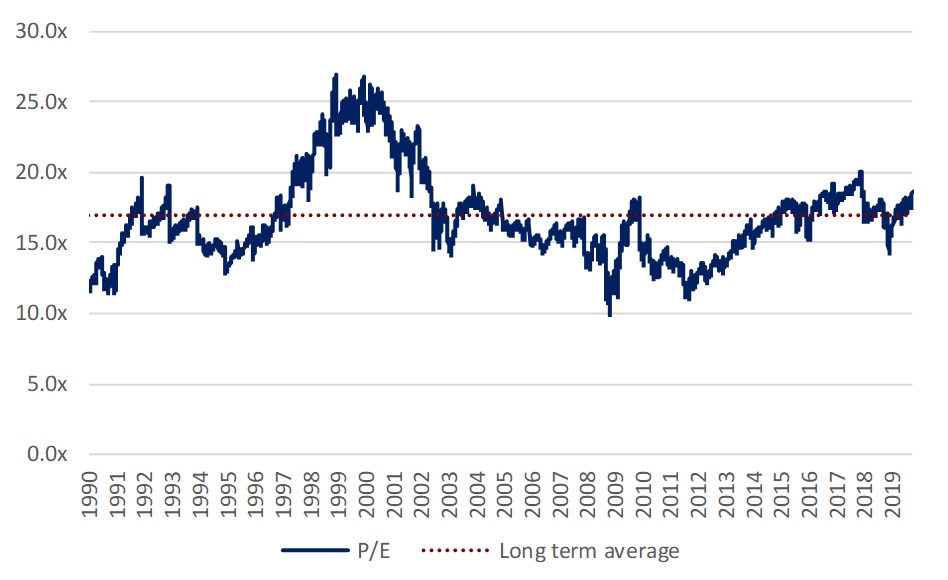

With that caveat in place, we list below our thoughts on equity markets. We believe there are three key drivers of long-term market returns: valuations, interest rates and corporate earnings. We must admit to being somewhat bemused that most pundits describe markets as “very expensive” or “stretched”. Below we chart the S&P 500 since 1990. The current trailing PE ratio of 18.9x might give some support to the bears, at 11% above the average over that period.

Source: Bloomberg

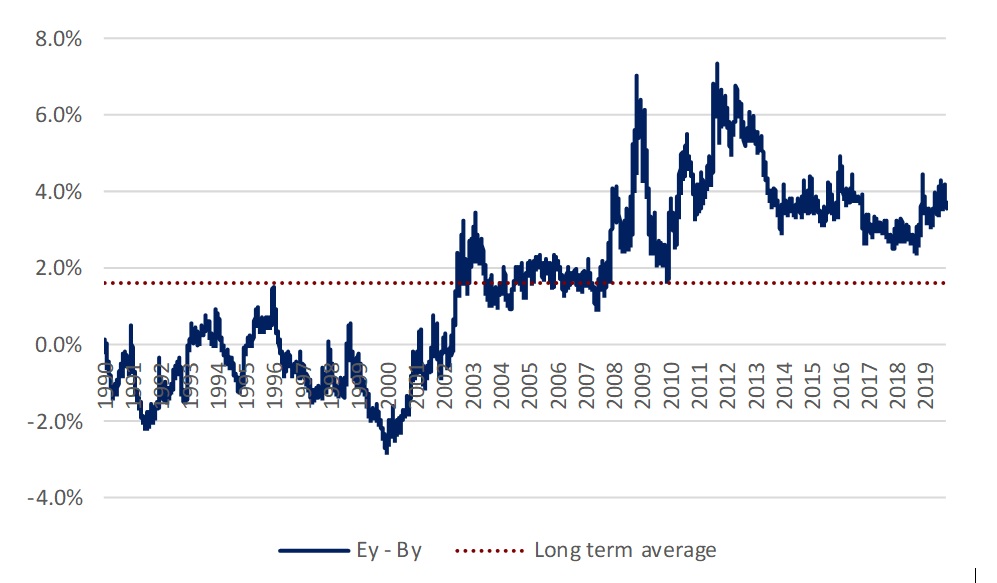

However, as Warren Buffett has said many times over the years, interest rates are like gravity for asset prices and we believe a more relevant metric is the difference between the earnings yield (the inverse of the PE ratio) and the return available on fixed interest assets. The current earnings yield is 5.4% versus a ten-year bond rate of 1.8%, leaving a premium of 3.6%. This compares to an average premium of 1.6% dating back to 1990.

Source: Bloomberg

For the bears to be proven right in 2020 will either require a large rise in interest rates or a dramatic collapse in profits. Whilst this is always a possibility, our recent discussions with companies remain positive (apart from pockets of weakness in industrials) - in marked contrast to the bearish headlines we read about in the financial press. In a recent Barron’s survey, fund managers were described as the most bearish since the great recession and carrying above average cash holdings.

We are reminded of Sir John Templeton’s maxim “bull markets are born in pessimism, grow on scepticism, mature on optimism and die on euphoria.” Anyone picking up a newspaper would hardly describe the world as euphoric!

As such, with equity markets still yielding very attractive returns relative to bonds, a benign economic backdrop with decent (although slowing) economic growth, muted inflation and an easing bias by central banks – there’s a case to be made that equity markets will keep climbing “the wall of worry.”

But as with most things Yogi Berra said it best and the reader should remember that “predictions are difficult, especially about the future.”